Prevention as an Asset Class

Make Prevention Investable

EDEN makes the breakeven boundary visible—so founders, payers, and investors know whether to commit or redesign.

Digital Diabetes Screening, Switzerland

- -Reach: Detection 2-3 years earlier reduces intervention cost

- -Report: Outcomes visible before payer budget cycles reset

- -Reimburse: Breakeven Year 4—inside 3-7 year investor horizons

In collaboration with

The Pillars of Future Healthcare

4P Medicine shifts reactive care into proactive care. EDEN calculates when those shifts meet realistic thresholds for payers, founders, and investors.

Four Timelines That Determine Breakeven

Operational inefficiency signals that breakeven will arrive too late. Four timelines determine whether prevention reaches breakeven early enough for payers to commit, founders to build, and investors to finance.

When can we detect risk and intervene before costs compound?

How long must users stay engaged before outcomes appear?

When can we show evidence before payer budgets reset?

When does breakeven appear relative to investor exit horizons?

When can we detect risk and intervene before costs compound?

How long must users stay engaged before outcomes appear?

When can we show evidence before payer budgets reset?

When does breakeven appear relative to investor exit horizons?

Prevention Market Map

Five recurring patterns where breakeven happens early enough for payers to commit, founders to build, and investors to finance.

| Company | Description | Investors | Deal | Year | EDEN Insight |

|---|---|---|---|---|---|

| Omada Health | Digital pre-diabetes reversal | Cigna Ventures, a16z, Kaiser Permanente Ventures | $50M | 2022 | Model ROI < 5 yrs for CGM + coaching |

| Hinge Health | MSK programs, 2yr payback | Tiger Global, Coatue, Insight Partners | $600M | 2022 | Quantify avoided ER/surgery costs |

| Virta Health | Self-insured corporates | Sequoia, Venrock, Cigna Ventures | $65M | 2022 | Target stable workforce contracts |

| Company | Description | Investors | Deal | Year | EDEN Insight |

|---|---|---|---|---|---|

| Aledade | Physician ACO network | Venrock, OMERS Growth, Meritech | $260M | 2023 | Savings-share ROI modeling |

| Doctor Anywhere | Primary-care DHTs (Singapore) | Novo Holdings, Asia Partners | $88M | 2022 | Prevention ROI in capitated systems |

| Oviva | Digital nutrition (EU) | Temasek, Sofina, MTIP | $80M | 2022 | National reimbursement frameworks |

| Company | Description | Investors | Deal | Year | EDEN Insight |

|---|---|---|---|---|---|

| CVS Health + Aetna | Pharmacy + payer merger | Merger | $69B | 2018 | Synergy ROI in integrated care |

| Cityblock Health | Medicaid super-utilizers | Alphabet GV, Emerson, Tiger Global | $400M | 2021 | ROI in underserved markets |

| Propeller Health | COPD monitoring | Acquired by ResMed | $225M | 2018 | Hospital-avoidance value capture |

| Company | Description | Investors | Deal | Year | EDEN Insight |

|---|---|---|---|---|---|

| Levels Health | Consumer CGM | a16z, General Catalyst | $44M | 2023 | CGM data to short-term ROI |

| Biofourmis | Predictive analytics | SoftBank Vision Fund 2 | $300M | 2022 | 90-day risk scores to contracts |

| Huma | Voice/gait monitoring | Leaps by Bayer, SoftBank, Sony | $130M | 2022 | Outcome-based payments via RWD |

| Toku Eyes | AI retinal screening | Icehouse Ventures, NZ Gov Fund | $8M | 2023 | Diagnostic AI in preventive contracts |

| Company | Description | Investors | Deal | Year | EDEN Insight |

|---|---|---|---|---|---|

| Ro | Sexual health, weight loss | General Catalyst, FirstMark | $150M | 2021 | DTC pricing for cash flows |

| Hims & Hers | Hair loss, sexual wellness | Forerunner, Redpoint, IVP | $200M | 2021 | Low-friction consumer model |

| Headspace Health | Mental health (merger) | Blackstone Growth, KKR | $3B | 2021 | B2B2C employer programs |

| Lyra Health | Employer-paid therapy | Accel, Dragoneer | $235M | 2023 | Employer WTP and retention ROI |

| Altoida | Digital cognition biomarkers | M Ventures (Merck), Evidation | $20M | 2022 | Preventive ROI in neurodegeneration |

EDEN calculates which interventions reach breakeven in under 5 years, under which payment structures, with which integration strategies—making breakeven timelines visible so you know whether to commit, redesign, or reallocate.

EDEN: Your Breakeven Calculator

Three modules that answer: When does prevention reach breakeven? How confident can you be in that estimate?

Why Breakeven Is Blocked

System-fit constraints: payer discounting, provider friction, patient time preferences. Explains why breakeven is delayed or unreachable.

Diagnoses Reach and Retain barriers to breakeven.

When Evidence Appears

Clinical pathways translated into outcome timelines and system-adjusted QALYs. Shows when evidence materializes relative to breakeven.

Maps Report timing relative to payer budget cycles.

Where Breakeven Sits

ROI timelines under real discounting and uncertainty. Calculates breakeven year, valuation curves, and confidence intervals.

Determines Reimburse timing relative to investor horizons.

Find Breakeven Before the Market Does

Weekly signals on prevention investments where breakeven timelines align. Transparent models. Auditable assumptions.

How It Works

EDEN leverages unstructured real-world data to computationally reveal which prevention models create measurable returns—and why.

From raw data to investment-ready signals

- OECD, World Bank & WHO – macroeconomic and population metrics

- PitchBook & Crunchbase – venture funding intelligence

- PubMed – scientific and clinical studies

- FDA Database – regulatory approvals

- IP Databases (USPTO, Espacenet) – early technology signals

- Hospital Statistics – national healthcare and cost data

- HTA Databases (Swiss HTA, NICE) – reimbursement benchmarks

Digital Diabetes Screening, Switzerland

When does this intervention reach breakeven—and how confident can we be in that estimate?

Breakeven Timeline

Reach

Digital biomarkers cut diagnostic delay 2-3 years, reducing intervention cost.

Retain

Tailored nudges sustain engagement long enough for metabolic outcomes to appear.

Report

Glucose improvements visible before payer budget cycles reset.

Reimburse

Breakeven Year 4 fits inside 3-7 year investor exit horizons.

Decision

Can a consumer diabetes app work as an investment in Switzerland? Yes, when breakeven occurs Year 4.

Competitive moat: Regulatory and clinical barriers keep competitors out. Pure software cannot replicate the clearances and evidence required for payer contracts.

Moat Duration

Different prevention investments have different competitive windows:

Short

Examples: Wellness apps, meditation apps

Easy to copy. Pure software. No lasting advantage.

Medium

Examples: Glucose monitors, AI diagnostics with proprietary data

Requires hardware, regulatory approval, or clinical proof.

This case fits here

Long

Examples: Integrated health systems, employer clinics

Structural positions. Not typical investment targets.

Breakeven Calculation

Why Breakeven Is Blocked (or Not)

Accelerates Breakeven

Consumer willingness to pay. Proven technology. Measurable outcomes.

Delays Breakeven

Insurance reimbursement unclear. Weak policy support. Hospital integration friction.

When Evidence Appears

Early adopters pay out of pocket. Scale requires employer or insurer contracts. Evidence must materialize before payer budget cycles reset.

Where Breakeven Sits

Breakeven Year 4 at 18,446 users (under 0.5% of Swiss adults). At 30,000 users by Year 6, valuation CHF 0.94-3.2M under varying risk tolerance.

Long-term success requires B2B insurer contracts to sustain retention and reach breakeven.

Breakeven Metrics

| Metric | Value | Breakeven Impact |

|---|---|---|

| Breakeven Year | Year 4 | Inside investor exit horizons |

| Required Market Share | Under 0.5% | Achievable penetration |

| Valuation at 30k Users | CHF 0.94-3.2M | Reflects discounting uncertainty |

| Scale Strategy | B2B | Insurer contracts sustain Retain |

Market Context

Market Size 2030

15-20% annual growth

EDEN Filter Accuracy

Screens misaligned timelines

Lead Time

Before market consensus

Sample breakeven outputs (2024 data). Not investment advice.

Why It Works

Peer-reviewed methods translating health innovation into investment decisions

Every paper summary includes actionable insights for investors, payers, and founders—no academic jargon

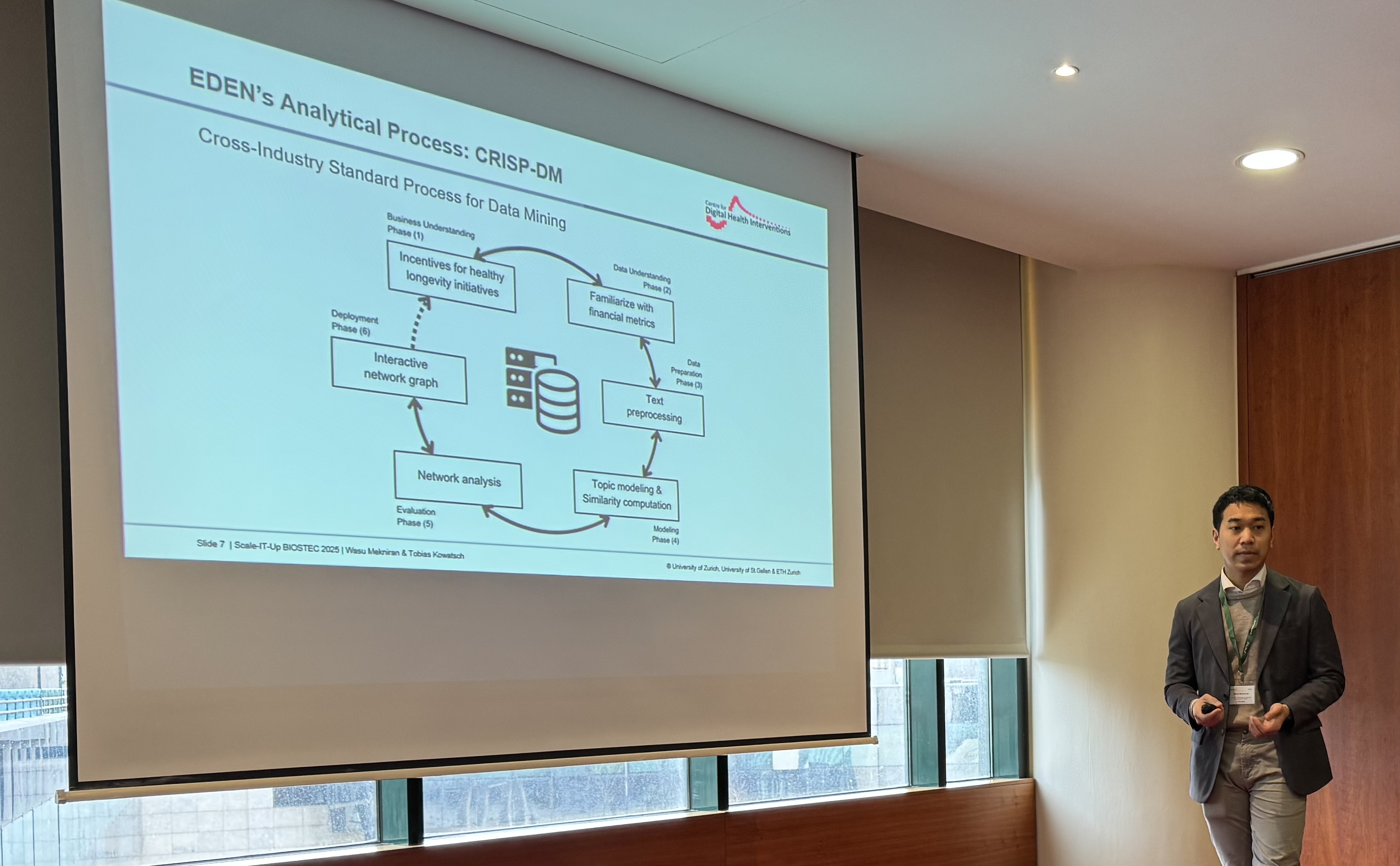

Wasu Mekniran, Tobias Kowatsch

Biomedical Engineering Conference - Portugal

💡 Investor takeaway:Unstructed data can be harvested for early systemic insights.

What This Unlocks

Investors:

Demonstrates scalable AI approach to market analysis and stakeholder mapping for prevention ventures

Payers:

Provides framework for identifying aligned partners in prevention ecosystem

Founders:

Offers methodology to map competitive landscape and identify strategic partners

Wasu Mekniran

💡 Investor takeaway:Use EDEN's thresholds instead of biotech heuristics to avoid overpaying for DHT optionality.

What This Unlocks

Investors:

Reveals why DHT investments require different evaluation criteria than traditional biotech

Payers:

Explains structural challenges in DHT reimbursement compared to pharmaceutical products

Founders:

Identifies four strategic positioning options for DHT competitive advantage

Wasu Mekniran, Lukasz Paciorkowski, Iwona Cymerman, Rafal Pawlowski

4th Swiss-Polish Economic and Technology Forum

💡 Investor takeaway:AI-first development reduces costs by 70%—prioritize companies with AI infrastructure.

What This Unlocks

Investors:

Quantifies cost savings and efficiency gains from AI adoption in drug development

Payers:

Shows potential for lower drug costs through AI-enabled development efficiency

Founders:

Demonstrates competitive advantage of AI-first development approach

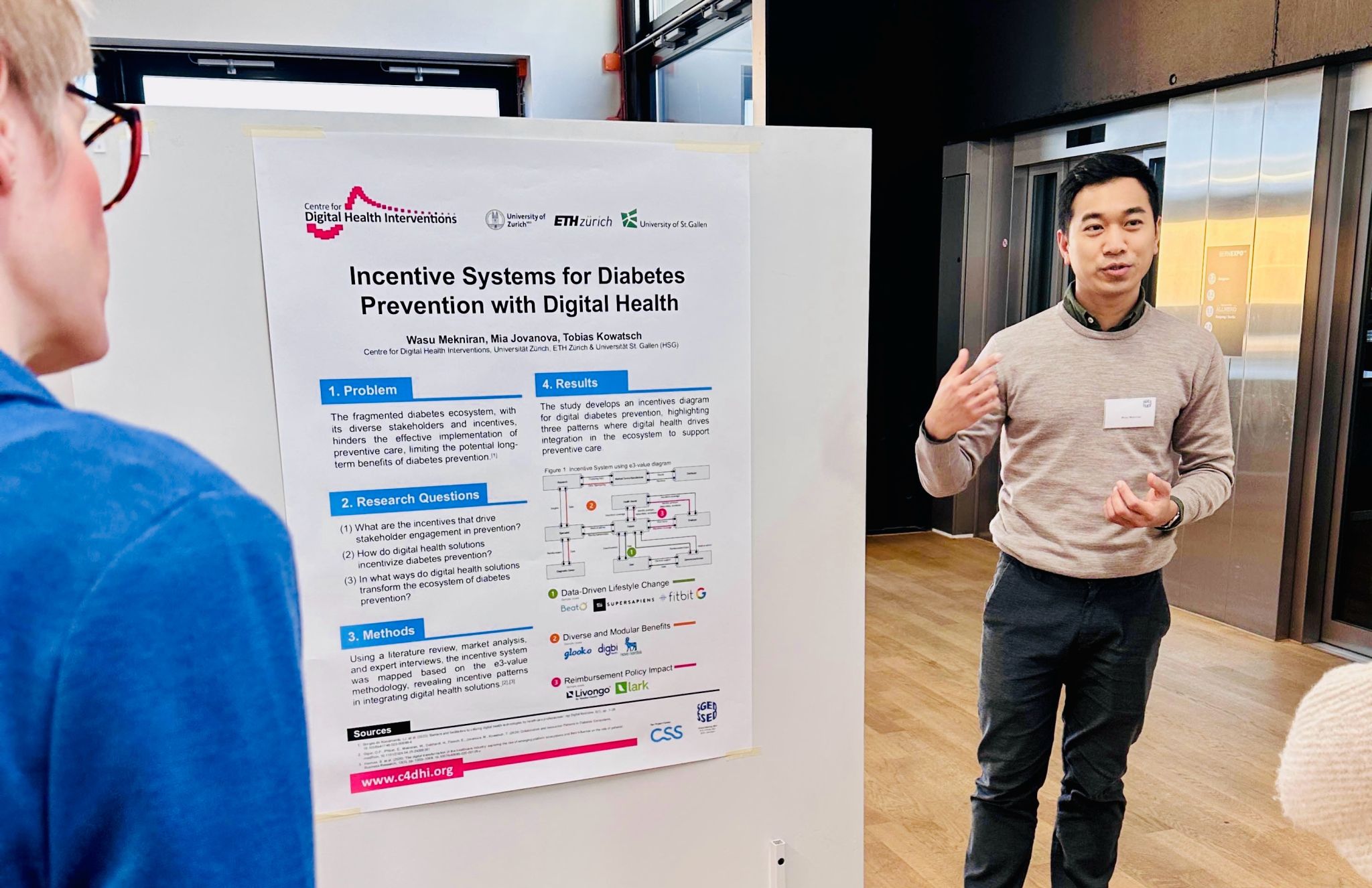

Wasu Mekniran, Mia Jovanova, Tobias Kowatsch

Swiss Society of Endocrinology and Diabetes 2024

💡 Investor takeaway:Three contract models identified—target data-driven lifestyle change for fastest ROI.

What This Unlocks

Investors:

Maps value flows and revenue opportunities in diabetes prevention ecosystem

Payers:

Identifies three contract models for diabetes prevention reimbursement

Founders:

Reveals critical partnerships needed to align incentives for market entry

Wasu Mekniran, Jan-Niklas Kramer, Tobias Kowatsch

Biomedical Engineering Conference - Italy

💡 Investor takeaway:NCDs and stigmatized conditions have highest payer appeal—prioritize these segments.

What This Unlocks

Investors:

Reveals insurer decision criteria and three strategic pathways for DHT partnerships

Payers:

Outlines three business model options for insurers entering prevention market

Founders:

Identifies which DHT categories have highest payer appeal and why

Wasu Mekniran, Tobias Kowatsch

Biomedical Engineering Conference - Portugal

💡 Investor takeaway:B2B2C models outperform D2C—prioritize employer partnerships for scale.

What This Unlocks

Investors:

Identifies proven business model patterns from $1.73B in successful DHT funding

Payers:

Shows why B2B2C models outperform direct-to-consumer in prevention

Founders:

Provides blueprint for scalable business model design in longevity space

Wasu Mekniran, Odile-Florence Giger, Elgar Fleisch, Tobias Kowatsch, Mia Jovanova

SWU Biomedical Engineering Dept.

💡 Investor takeaway:Five strategies to bridge academic-community gap—target underserved niches for market entry.

What This Unlocks

Investors:

Maps global longevity ecosystem to identify underserved niches and partnership opportunities

Payers:

Reveals alignment gaps between research and community needs for prevention programs

Founders:

Identifies five strategies to bridge academic-community gap for market validation

Wasu Mekniran, Research Team

NUS Healthy Longevity Academy

💡 Investor takeaway:Consumer WTP data coming Q3 2025—early insights available on request.

What This Unlocks

Investors:

Will reveal consumer willingness to pay for longevity interventions

Payers:

Will show population health priorities for prevention program design

Founders:

Will identify consumer segments most receptive to longevity products

Make Better Decisions

EDEN tells you when prevention reaches breakeven—and how confident you can be in that estimate—so you know whether to commit, redesign, or reallocate.

Wasu Mekniran M.Sc. MBA

Researcher, ETH Zurich & HSG | Healthcare Financing & Digital Health

We build the analytical infrastructure to calculate when prevention reaches breakeven. We combine health economics with financial modeling to answer: When? And how confident can you be?

"Prevention fails when breakeven comes too late."

System fit + evidence timing + financial modeling = breakeven visibility for payers, founders, and investors.

Ready to calculate breakeven for your next prevention investment?