Category: Finance & Accounting

(81 von 100)

Why: I want to do a better job at bookkeeping.

Goal: learn key accounting and bookkeeping principles.

Table of Contents

Action: Do a Trial Balance Before Any Reporting.

3 Key Concepts

- Bookkeeping is not accounting.

- Stick to the principles.

- Understand basic lingo, accounting is a business language.

Summary

How to do a trial balance?

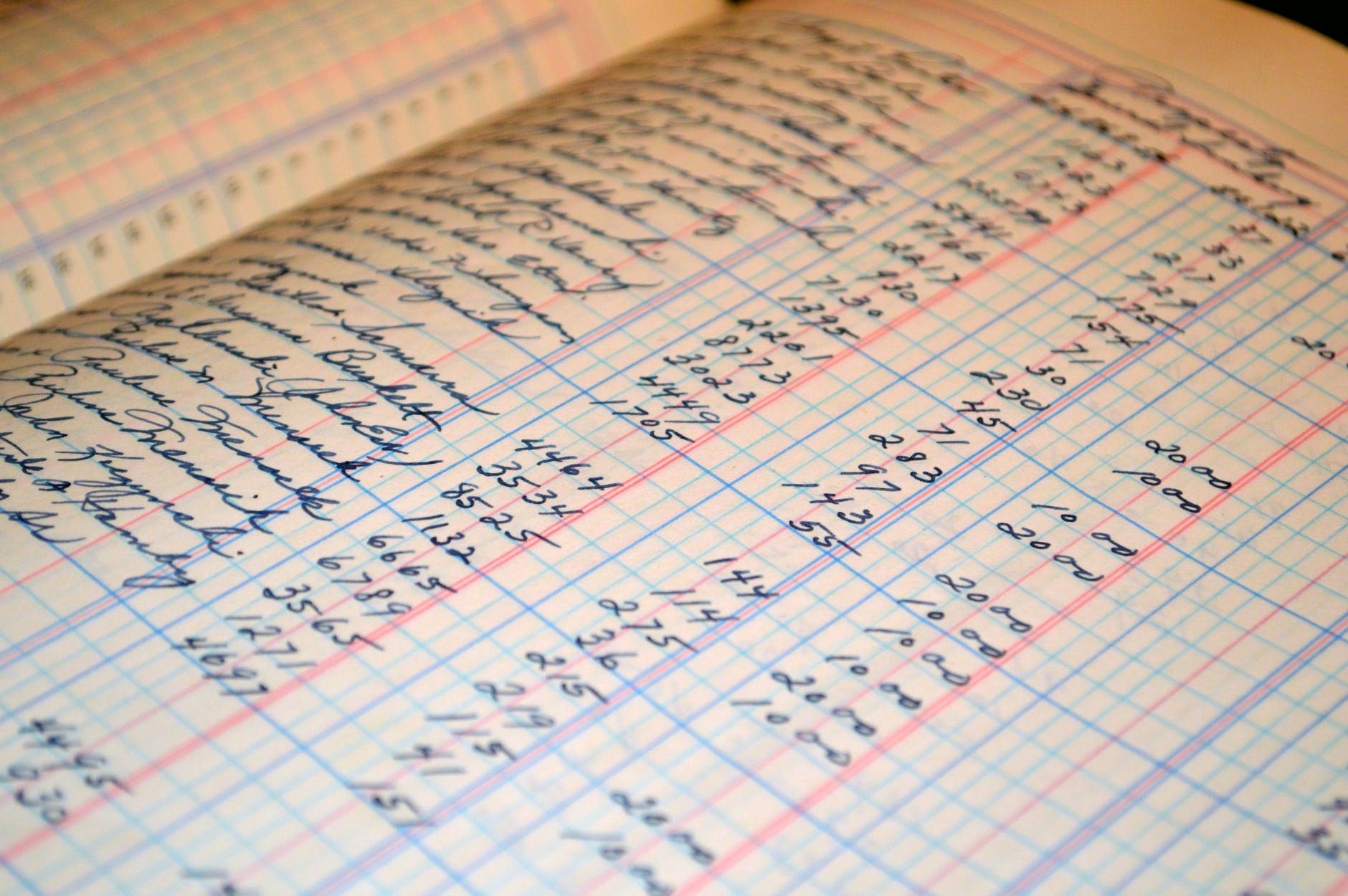

The basic core of accounting and bookkeeping: trial balance is a financial statement, where credit and debit transactions of a business are kept balance (equal).

AKA Double Entry System of Accounting.

When it is not in balance, some transactions have been mined or inaccurately entered into the ledger.

Check out also: Concept, Preparation, Example of trial balance

This book lays down the most fundamental concepts of bookkeeping and accounting. Highly recommended by both business students and non-business students.

Accounting vs Bookkeeping

Accounting

The process of consolidating, summarizing, analyzing, and reporting the financial record of a company.

Bookkeeping

The practice of recording all the processes of accounting.

Key Principles of Accounting

Bookkeeping must be good. Good in this case means accurate, that a bookkeeper enters all transactions correctly, without any missing item. Here are some key accounting and bookkeeping principles to hold on to.

- Assume that every business is an economic entity that aims to profit and grow.

- All transactions must be recorded in the same currency.

- All financial reports show results over a distinct period of time.

- Cost of an item does not change in the time of reporting withstanding.

- Revenue should be reported when it is earned, not received.

- Record liabilities and expenses before gains and revenues to avoid excess taxation due to poor record-keeping.

Some business vocabs

- Enrolled Agent: a tax expert who represents taxpayers when dealing with the internal revenue authorities.

- Asset Classes: Equities, Fixed income bonds, and Cash equivalents.

- Retained Earnings: the profits of a business that are plowed back into the company after paying taxes and dividends.

- Insolvency: a state of negative owner’s equity, in that the assets of the company are way lesser than the liabilities.

- Bonds: when an investor loans money to another entity with the promise of the money back with interest.

- Coupons: the annual interest paid on top of the bond.

To sum up

Bookkeeping and accounting are not the same things, but they need each other to function properly. Therefore, to keep your book clean and balanced, you should hold a basic accounting principle in mind and put them into practice.

Goal check: I learned basic principles of accounting.

Wasu’s Review

( 4.5 / 5.0 )

Get this book on Amazon here!