Category: Finance & Accounting

(60 von 100)

Original Japanese title: 基本税法 栄光社

Why: I need to understand common tax laws before meeting tax advisor candidates.

Goal: List 15 tax questions relating to my current business situation.

Table of Contents

Action: Prioritize Specific Experiences of Advisor.

3 Key Concepts

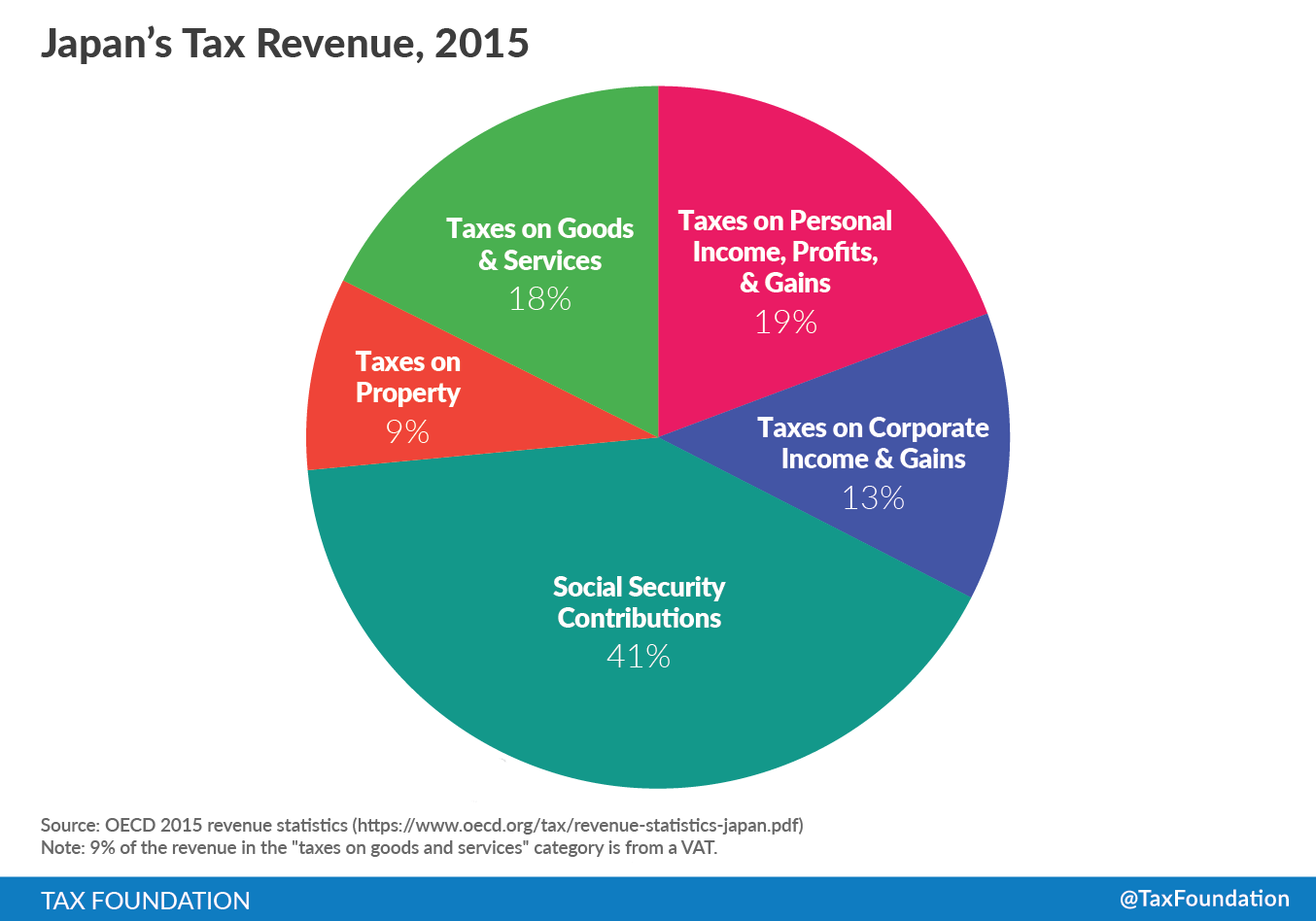

- Roughly half of public income is from a sum of income, corporate, and consumption taxes.

- There are multiple (specific) types of income in the eye of tax law.

- Taxation has fixed formula, but the application is situational.

Summary

How to prioritize your tax advisor’s experience?

Ask the following questions.

- Have you had experiences with tax audits?

- What is your expert field? Import/Export, Real estate, Corporate?

- Who are your main clients? big/small companies, local/international?

- Are you a one-man shop or an enterprise?

- Are you familiar with a client with my personal background?

This book is a basic introduction to the 3 most fundamental taxes: Income tax, Corporate tax, and Consumption tax.

To be honest, I cannot get enough of it.

If you are not excited about law, study tax law. Why? Money saved can be a huge motivation 😉

In Japan, it is quite easy to remember the constitutes of public income. Half tax and half debt.

- Income tax: 19%

- Corporate tax: 13%

- Consumption tax: 18%

- Property tax: 9%

From 2015 Japanese public income

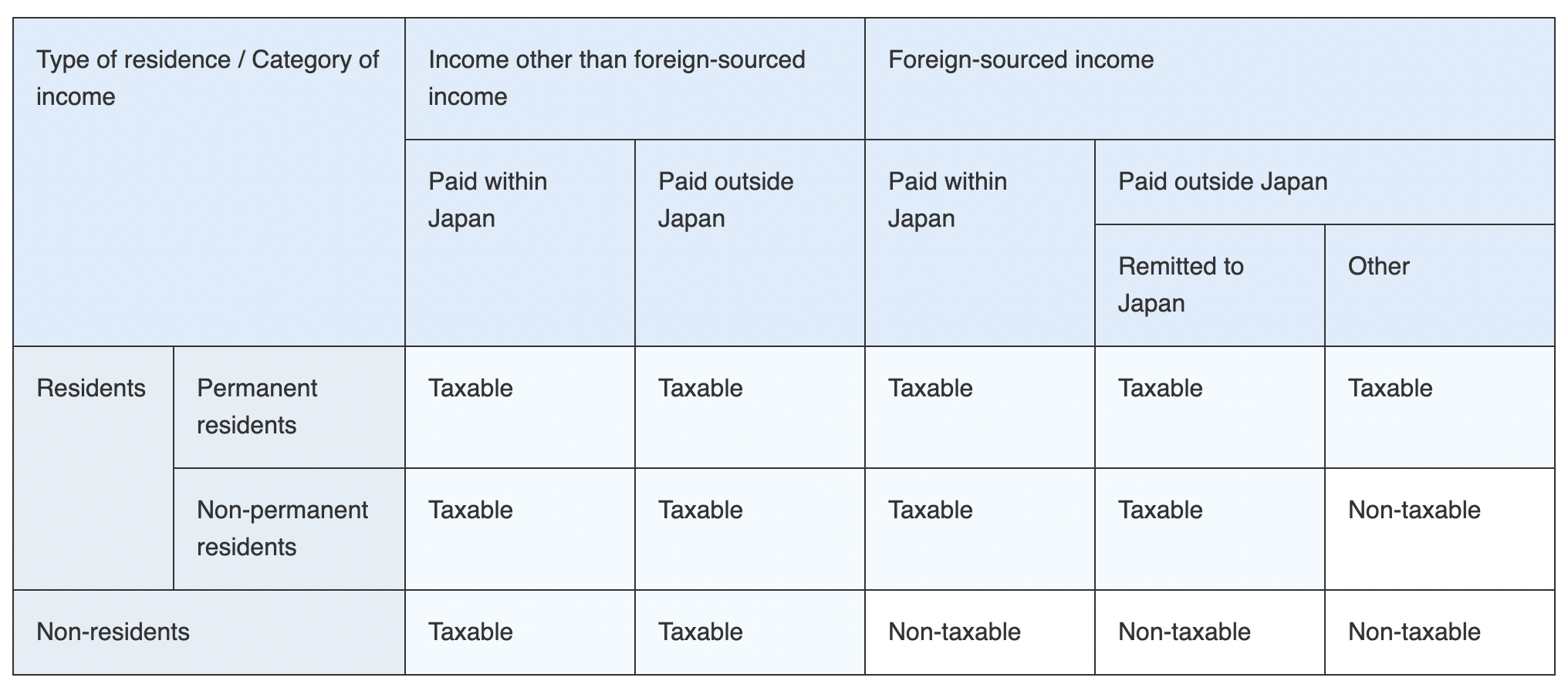

Before you get tactical about taxes, you need to understand how your law sees your income. With that being said, one sure way to avoid taxes is to have no income at all ;p

And also depends on your status in that country. Visa and residence permit.

To sum up, taxation has a fixed formula, but the application is situational. That is why it requires experience.

Goal check: I listed a total of 17 tax questions, and I am ready to ask all of them.

Wasu’s Review

( 4.0 / 5.0 )