Original title: 経営がみえる会計 田中靖浩

Category: Finance & Accounting

(59 von 100)

Why: I am still confused about financials and usages.

Goal: learn a practical concept of Profit/Loss statement and Balance sheet.

Table of Contents

Action: Think back to the basics – Investment and Return.

3 Key Concepts

- Accounting is there to show us where business stands.

- Find out what the root cause of “More Sales, less profit.” is.

- P/L and B/S make “Investment and Return” clear on papers.

Summary

How to go back to the basics?

Do not get carried away. Focus on the roots: Investment (Input) and Return (Output). Many who are starting a business will be overwhelmed with numbers from financials. (see more on Seeing the Big Picture by Kevin Cope)

As my favorite business plan goes,

Wasu M.

“Buy it for $2 and sell for $5.”

This book is, as mentioned above, very similar to Seeing the Big Picture by Kevin Cope in terms of “Easy to read,” but it focuses more on the Profit and Loss statement and Balance sheet.

What is accounting for?

It is for us to check the status and measure business performance. There are 2 types of accounting:

- Financial Accounting is for public investors and legal authorities like taxes.

- Managerial Accounting is for internal use.

More Important

For us – business owner: Managerial accounting is here to show us where the business stands at the point in time (outcome) and how it came about (cause). In short, the book discusses 2 basic (main) financial reports.

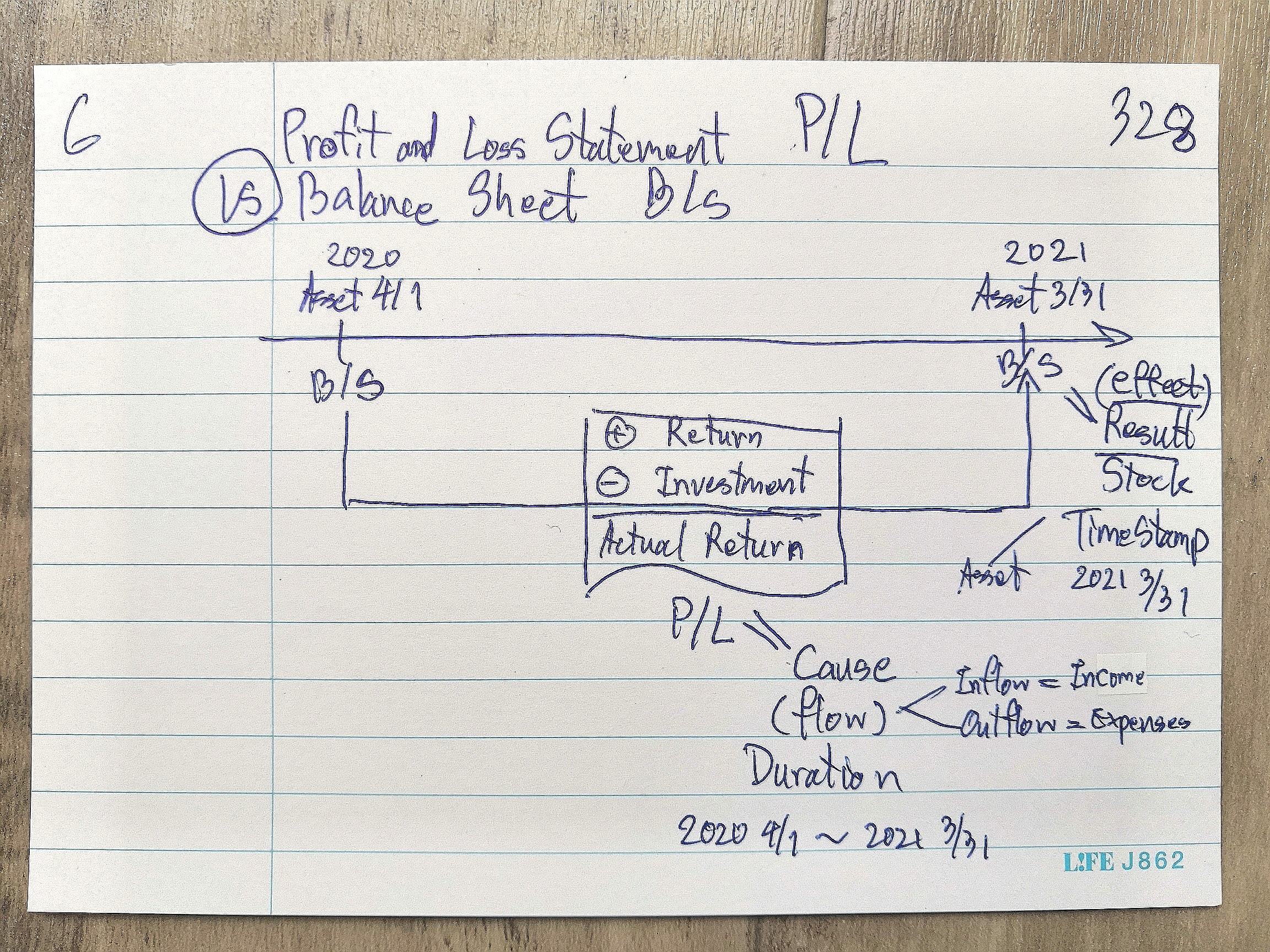

Balance Sheet: a time-stamp outcome of your business; it shows how investment generates a return.

Profit and Loss: a flow of investment and return in a time frame; it explains how assets ended up on the balance sheet.

Accounting shed the light on the path which you are taking. Without it, you are walking the dark.

You see, the problem is that many of us are messing with the numbers to make a time-stamped picture (B/S) look pretty. And therefore, you ended up don’t understand the linking causation. The key is to separate between financial accounting and internal use managerial accounting.

Why do we need accounting?

Keeping track of Investment and Return? Do we really need to go through this whole accounting process just to understand the company’s performance? In conclusion: YES.

4 company patterns

- More Sales and More Profit: great performance = minority of businesses

- Less Sales but More Profit: insanely good performance = mostly a lie

- More Sales but Less Profit: problematic performance = this is why we need accounting

- Less Sales and Less Profit: worst performance = majority of businesses

No. 3 needs close attention to specify what went wrong and who caused it. Because the Cost of Goods Sold (COGS) is higher than the profit. More sales will actually accumulate more debt!

Here is where accounting will come in and show us whether the fault is on the Sales department or Manufacturing department.

Your mission is

Understand the Profit and Loss Statement and Balance sheet to achieve the following goals.

Strengthen finances: procure sufficient fund.

A balance sheet shows the result of company investment in each asset.

P/L statement shows the reason for profit or loss and cause of asset results on the B/L sheet.

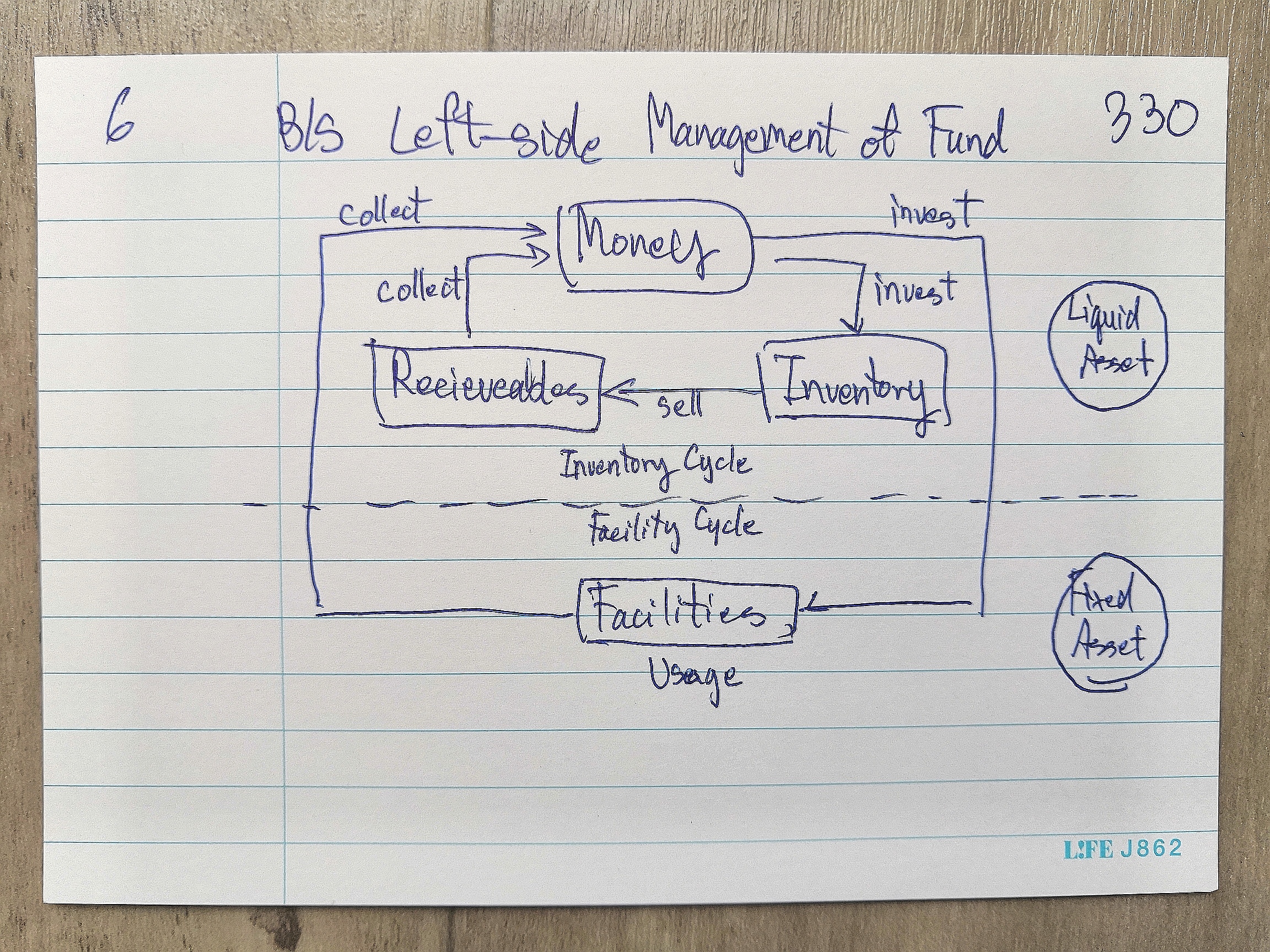

Control cashflow: manage liquid and fixed assets.

Earn more profit: manage your fund.

Back to the basics: measure Investment and Return = Return on Equity (ROE)

To sum up, the book explains well on basics of business and how it shows on financial reports. I highly recommend everyone willing to give accounting one more try 😉

Goal check: I learned a practical concept of why accounting is important to us – business owners.

Wasu’s Review

( 5.0 / 5.0 )

Get this book on Amazon here!