Category: Finance & Accounting

(58 von 100)

Original Japanese Title: 税理士をめざす人の本 成美堂出版

Why: I need to file taxes by myself from now on.

Goal: learn how to become a tax advisor in Japan.

Table of Contents

Action: Study Income, Corporate, and Consumption Taxes.

3 Key Concepts

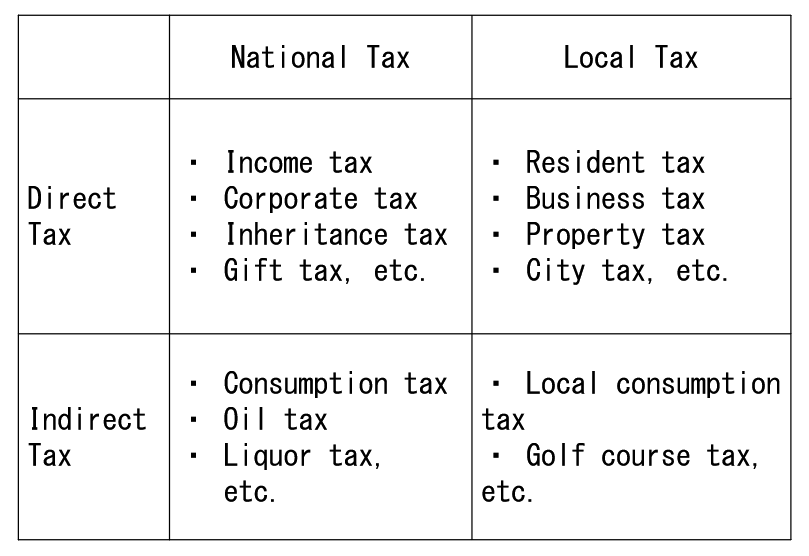

- Taxation can be categorized: National/Local, Direct paid/Indirect paid, Type of Activities.

- Learning what tax is for, helps us understand our society finances.

- Tax advisor does more than tax filing: taxation, accounting, consulting.

Summary

How to study taxation?

In Japan, the exam balances between law and regulations memory and tax calculation highly depend on the subject – I assume the same for other countries.

The book suggests that you start from “Book-keeping.” Then, most familiar consumption tax, income tax, and then corporate tax.

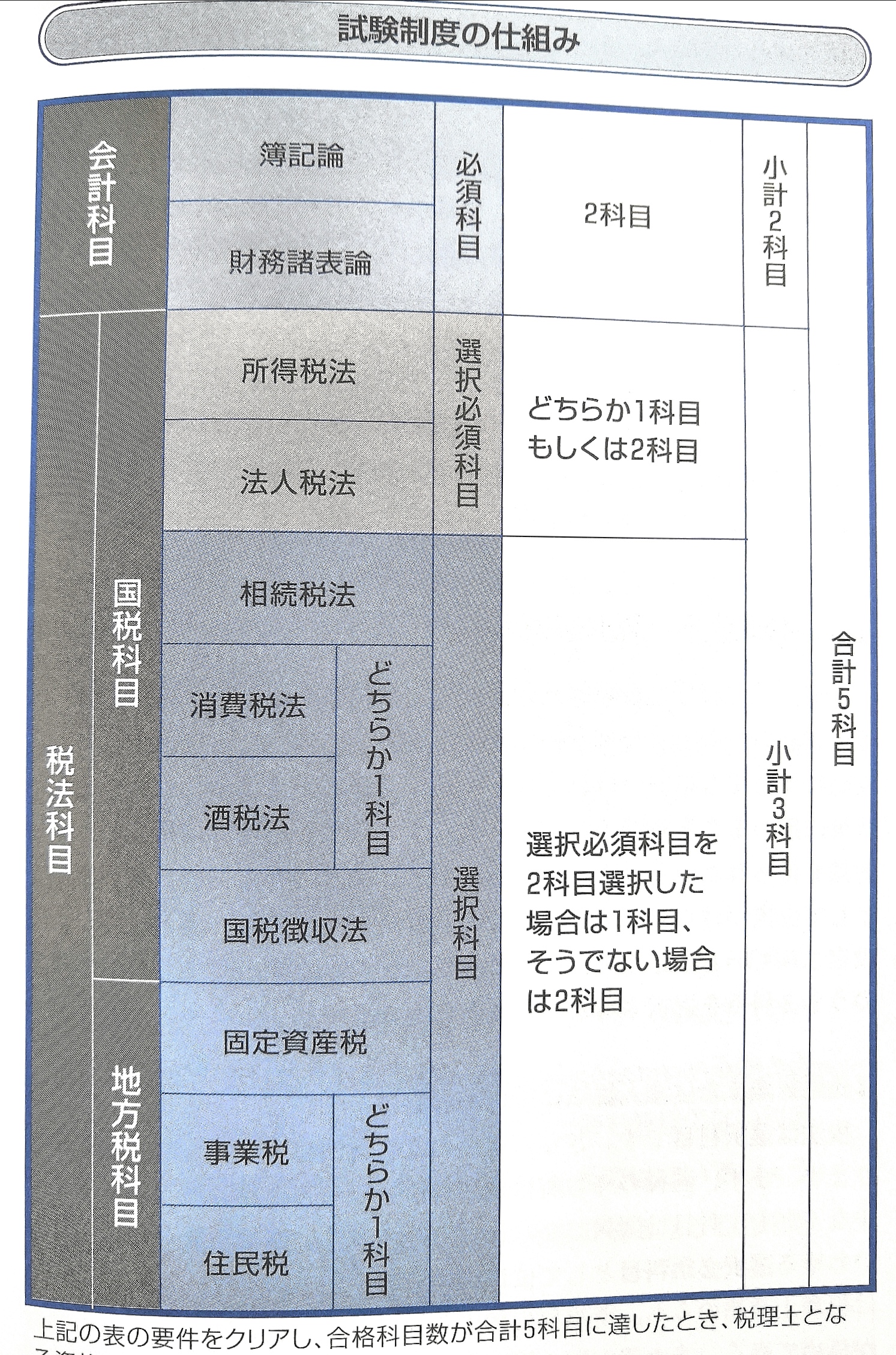

Yes, besides these 3 abovementioned taxes, there are 6 more taxes in the Japanese Tax Advisor exam. (+2 Accounting subjects, so a total of 11) Just for those who are curious, one needs to clear 2 accounting subjects and 3 taxes to get the tax advisor license.

This book has summarized how to study tax exams to get a license in Japan. It also says about what the daily work as a tax advisor is like and other tips.

If you happen to be here and want to get the Japanese tax advisor license, this book is a good overview.

First, what is tax for? Why are we paying it? How?

Tax is, in short, a membership fee to join the community. In this case, a national membership to live in any country as a citizen. It is used on many things involving public social facilities and services, including garbage recycling, policies, fire department, hospital, school, roadway, etc.

You must imagine how horrible it would be to take care of everything by yourself without these public services. “Get rid of your own poop, etc.” And

As somebody gotta do it for you, it costs money (TAX)!

Why? Well, it is a law. You, as a citizen, have a tax duty.

Taxes are what we pay for a civilized society.

Oliver Wendell Holmes,

former Justice of the United States Supreme Court

How?

This is where it gets interesting. Since there are so many laws and regulations, we need to study each type of tax. Of course, how much is situational, therefore calculation is an art to study.

Let’s face it, even we all now understand that money goes to our society, tax advisors are there to help you pay as little as you allow to avoid them.

What do tax advisors do?

There are 2 types of work: work that only tax advisors can do and work that tax advisors do better than non-advisor.

Work that only tax advisors can do

- Tax advising duh

- Tax document preparation

- Tax filing instead of client

- Tax related representative in court

Work that tax advisor do better then non-advisor

- Accounting

- Business consulting

- Training on taxation

To sum up, learning any law will help you protect yourself from legal mistakes and injustice in society. Tax law is, in my opinion, one of the most practical laws to study. It is crucial even when you are building a company.

I actually studied the basics of all 11 taxes in Japan. So let me know if you guys are interested in reading about the Japanese taxes overview, hahaha.

Goal check: I learned how to become a tax advisor in Japan.

Wasu’s Review

( 4.0 / 5.0 )

Get this book on Amazon here!

Bonus: what exams do you need to pass to become a Japanese Tax advisor?